This three-part series focuses on what employers should be doing now for 2018 ACA compliance and reporting.

According to Affordable Care Act regulations, all employers with more than 50 full-time or full-time equivalent employees are considered to be an Applicable Large Employer (ALE) and, as such, are subject to the employer shared responsibility provisions of the ACA.

It’s important to review your ALE status, especially if there have been any changes in your company. Maybe when ACA was first mandated, your company employed less than 50 full-time or full-time equivalent employees, but now your company has grown over the past three years. Or perhaps you weren’t sure exactly how to count employees if your company employs workers throughout the year with seasonal peaks. The information presented here will assist in determining whether or not your company is an ALE.

ALE status for any particular calendar year depends on the size of the employer’s workforce in the preceding calendar year. For example, as an employer, you will use information about the size of your workforce during 2017 to determine if you are an ALE for 2018 ACA compliance and reporting.

ACA Definition of Full-Time Employee

Determining the size of your workforce will depend on the number of full-time or full-time equivalent employees. For ACA, full-time employees are defined as individuals employed, on average, for at least 30 hours of service per week during the month or at least 120 hours of service during the month. “Full-time equivalent” employees means a combination of part-time employees that count as one or more full-time employees.

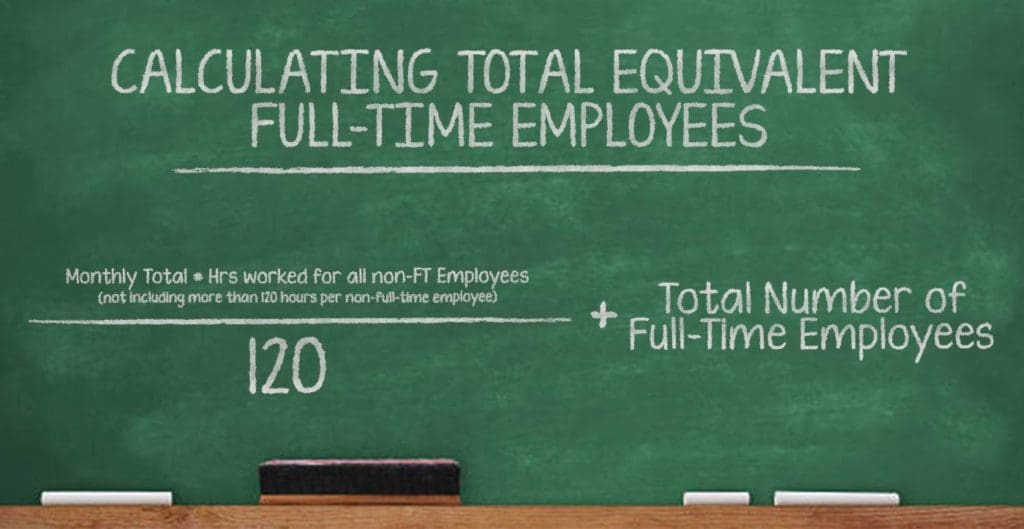

An employer determines its number of full-time equivalent employees for a month by combining the number of hours of service of all non-full-time employees for the month (not including more than 120 hours of service per employee), and dividing the total by 120.

For example, an employer that employs 40 full-time employees and 20 employees who each have 60 hours of service in a month has the equivalent of 50 full-time employees in that month (40 full-time employees plus 10 full-time equivalent employees [20 X 60 = 1200, and 1200/120 =10]).

How to Determine ALE Status

You can determine your ALE status for 2018 ACA compliance and reporting by calculating your total equivalent FTEs from 2017 data. Here’s an easy-to-use calculator:

If your Total Equivalent FT Employees is 50 or more, you qualify as an ALE for 2018 ACA compliance and reporting.

*not including more than 120 hours per non-full-time employee

Part Two: Tracking Employees by Actual Hours Worked for ACA – click here to read.

Want to know more about 2018 ACA compliance and reporting? Click here to review upcoming ACA informational webinars.